Introduction

Estate planning is a crucial process that allows individuals to make informed decisions about the distribution of their assets and the management of their affairs in the event of incapacity or death. In Maryland, creating a comprehensive estate plan offers numerous benefits that can protect your interests, provide for your loved ones, and ensure your wishes are carried out according to law. This blog post will explore the key components of a Maryland estate plan, its benefits, and important considerations for Maryland residents.

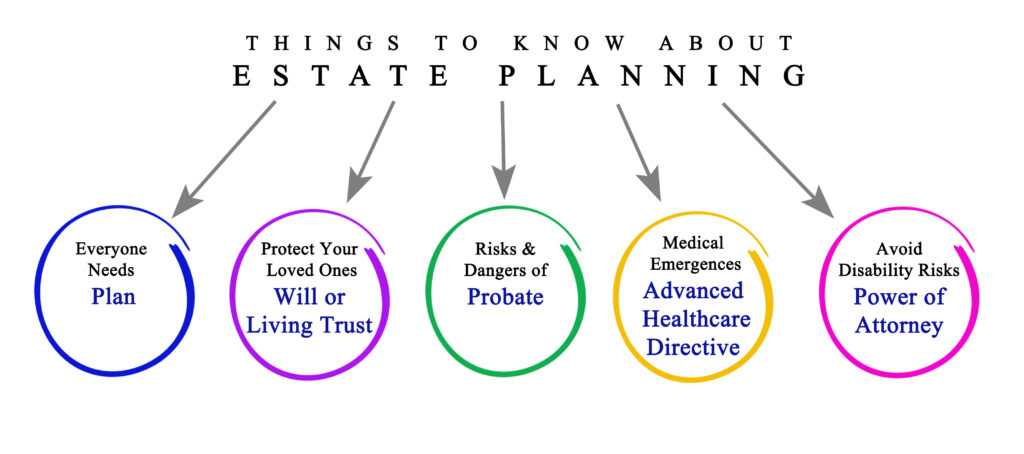

Key Components of a Maryland Estate Plan

Last Will and Testament

A will is a fundamental document in any estate plan. In Maryland, a valid will must be in writing, signed by the testator (the person making the will), and witnessed by two competent individuals, as required by Md. Code Ann., Est. & Trusts § 4-102. The will allows you to specify how your assets should be distributed upon your death and nominate a personal representative to manage your estate.

Revocable Living Trust

A revocable living trust is an increasingly popular estate planning tool in Maryland. This instrument allows you to transfer ownership of your assets to a trust during your lifetime while retaining control as the trustee. Upon your death or incapacity, a successor trustee manages and distributes the trust assets according to your instructions, often without the need for probate.

Power of Attorney

In Maryland, you can execute both financial and healthcare powers of attorney. These documents allow you to designate an agent to make financial and medical decisions on your behalf if you become incapacitated. Maryland law requires that powers of attorney be in writing and properly executed to be valid, as outlined in Md. Code Ann., Est. & Trusts § 17-101 et seq.

Advance Directive

An advance directive, also known as a living will, allows you to express your wishes regarding end-of-life medical care. Maryland law recognizes the importance of these documents in healthcare decision-making and provides specific forms for their creation under Md. Code Ann., Health-Gen. § 5-601 et seq.

Maryland Statutory Form Limited Power of Attorney

Maryland offers a statutory form limited power of attorney, which provides a standardized document for granting financial powers to an agent. This form, found in Md. Code Ann., Est. & Trusts § 17-203, can be a valuable addition to your estate plan, offering clarity and legal certainty.

Minimizing Probate

Probate is the court-supervised process of administering a deceased person’s estate. In Maryland, probate can be time-consuming and costly. According to the Register of Wills for Maryland, probate fees can range from $50 to $2,500, depending on the estate’s value (Md. Code Ann., Est. & Trusts § 2-206). Additionally, executor fees and attorney fees can further increase costs. A well-crafted estate plan, particularly one utilizing a revocable living trust, can help minimize or avoid probate altogether, saving your beneficiaries time and money.

Example: John, a Maryland resident, created a revocable living trust and transferred his home, investments, and bank accounts into the trust. Upon his death, these assets passed directly to his beneficiaries without going through probate, saving his family thousands of dollars in probate fees and months of court proceedings.

Tax Benefits

Maryland imposes both an estate tax and an inheritance tax, making tax planning a crucial aspect of estate planning. As of 2021, Maryland’s estate tax exemption is $5 million, meaning estates valued below this threshold are not subject to state estate tax (Md. Code Ann., Tax-Gen. § 7-309). However, proper planning can help minimize tax burdens for larger estates through various strategies, such as gifting and trust creation.

Regarding inheritance tax, Maryland is one of the few states that still imposes this tax. However, direct lineal descendants (children, grandchildren, etc.), spouses, siblings, and parents are exempt from inheritance tax. Other beneficiaries may be subject to a 10% inheritance tax on their inheritances (Md. Code Ann., Tax-Gen. § 7-203).

Example: Sarah, a wealthy Maryland resident, worked with her estate planning attorney to implement a gifting strategy. By making annual gifts to her children and grandchildren within the federal gift tax exclusion limits, she was able to reduce the size of her taxable estate and potentially save her heirs hundreds of thousands of dollars in estate taxes.

Control Over Asset Distribution

Without an estate plan, your assets will be distributed according to Maryland’s intestate succession laws (Md. Code Ann., Est. & Trusts § 3-101 et seq.), which may not align with your wishes. By creating a comprehensive estate plan, you maintain control over how your assets are distributed, ensuring your loved ones are provided for according to your desires.

Protection for Minor Children

If you have minor children, an estate plan allows you to nominate a guardian to care for them in the event of your death (Md. Code Ann., Est. & Trusts § 13-701). Additionally, you can establish trusts to manage assets for your children’s benefit until they reach an age you deem appropriate for inheritance.

Example: Michael and Lisa, parents of two young children, created an estate plan that included a testamentary trust. In their will, they nominated Lisa’s sister as guardian for their children and established a trust to manage their assets. The trust provisions ensured that funds would be available for their children’s education and support, with full distribution of assets occurring when each child reached age 25.

Digital Asset Management

In today’s digital age, it’s crucial to consider your digital assets in your estate plan. Maryland has adopted the Revised Uniform Fiduciary Access to Digital Assets Act (Md. Code Ann., Est. & Trusts § 15-601 et seq.), which provides a framework for managing and accessing digital assets after death or incapacity. Your estate plan can include provisions granting your fiduciaries access to your digital accounts, ensuring proper management of your online presence and digital property.

Example: David, an avid cryptocurrency investor, included specific provisions in his estate plan granting his executor access to his digital wallets and exchange accounts. This foresight ensured that his valuable digital assets could be properly accessed and distributed to his heirs.

Special Needs Planning

For families with members who have special needs, estate planning is particularly crucial. A properly structured special needs trust can provide for a disabled loved one without jeopardizing their eligibility for government benefits. Maryland law recognizes and provides for special needs trusts under Md. Code Ann., Est. & Trusts § 14.5-1002.

Example: Robert and Emily have a daughter with autism who receives Supplemental Security Income (SSI). They created a special needs trust as part of their estate plan to provide for their daughter’s supplemental needs without disqualifying her from essential government benefits.

Consequences of Not Having an Estate Plan in Maryland

Intestate Succession

If you die without a valid will in Maryland, your assets will be distributed according to the state’s intestate succession laws (Md. Code Ann., Est. & Trusts § 3-101 et seq.). This may result in unintended beneficiaries receiving your assets or your estate being divided in ways that do not reflect your wishes.

Family Conflicts and Legal Disputes

The absence of a clear estate plan can lead to disagreements among family members and potential legal battles. These conflicts can be emotionally draining and financially costly, potentially depleting the estate’s assets.

Lack of Control Over Healthcare Decisions

Without an advance directive and healthcare power of attorney, your family may face difficult decisions regarding your medical care if you become incapacitated. Maryland law provides a default decision-making process (Md. Code Ann., Health-Gen. § 5-605), but this may not align with your personal wishes.

Recent Updates and Considerations

As of 2021, Maryland has aligned its estate tax exemption with the federal exemption, which is indexed for inflation. This change makes it even more crucial to review and update your estate plan regularly to ensure it remains optimized for current tax laws.

Maryland’s Small Estate Administration

For smaller estates, Maryland offers a simplified probate process known as small estate administration. This process is available for estates valued at $50,000 or less, or $100,000 or less if the spouse is the sole beneficiary (Md. Code Ann., Est. & Trusts § 5-601). Understanding this option can be beneficial for those with modest estates.

Comparison with Neighboring States

While Maryland’s estate planning laws are comprehensive, it’s worth noting that neighboring states have different approaches:

Pennsylvania and Virginia do not have an inheritance tax, potentially making them more attractive for some estate planning purposes.

Delaware has no estate tax, which can be a consideration for high-net-worth individuals living near state borders.

These differences highlight the importance of working with a Maryland-specific estate planning attorney who understands the nuances of state law.

Selecting a Maryland Estate Planning Attorney

When creating or updating your estate plan, it’s essential to work with an experienced Maryland estate planning attorney. Look for an attorney who:

Specializes in estate planning and is familiar with Maryland’s specific laws

Stays current with changes in state and federal estate planning regulations

Can provide personalized advice based on your unique financial situation and family dynamics

Has experience with complex estate planning tools such as various types of trusts and tax-saving strategies

Conclusion

Creating a comprehensive estate plan in Maryland offers numerous benefits, including probate avoidance, tax minimization, asset protection, and peace of mind. By working with an experienced Maryland estate planning attorney, you can ensure that your wishes are properly documented and legally enforceable, providing for your loved ones and protecting your legacy.

Remember, estate planning is not a one-time event. As your life circumstances change and laws evolve, it’s important to review and update your estate plan regularly to ensure it continues to meet your needs and goals.

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. The information provided here may not be current or applicable to your specific situation. Laws and regulations change frequently, and their application can vary based on individual circumstances. Always consult with a qualified Maryland estate planning attorney for personalized advice regarding your estate planning needs.

Publication Date: May 1. 2025